Peer to peer lending no credit check

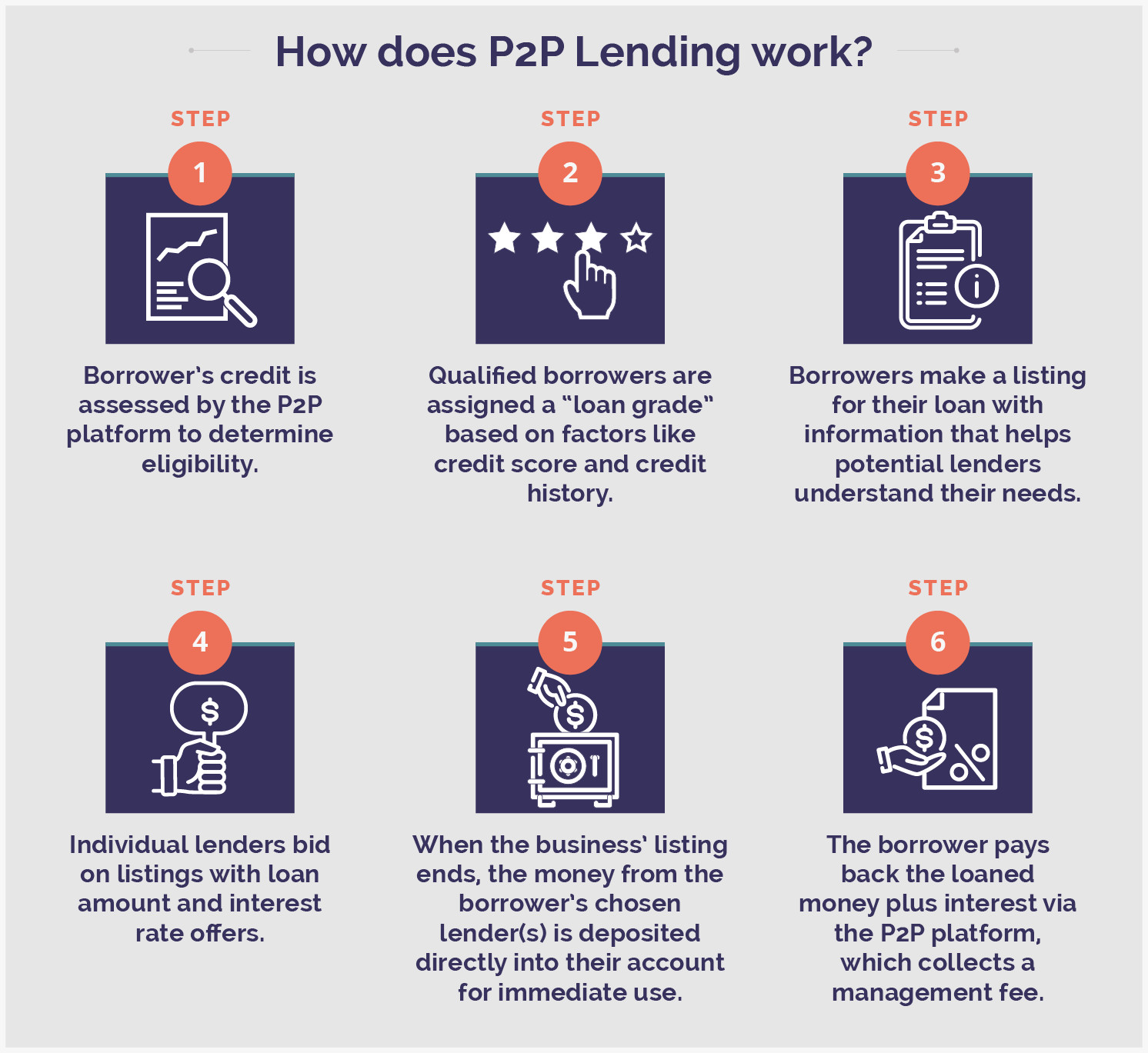

P2P personal loans are offered directly to individuals without the intermediation of a bank or traditional financial institution. A peer-to-peer P2P loan is a personal loan made between you and a borrower facilitated through a third-party intermediary such as Prosper or LendingClub.

What Is Peer To Peer Lending Here Are 5 Things To Know P2p Lending Peer To Peer Lending Social Finance

As weve warned it ISNT covered by the UK savings safety net which protects bank building society and credit union savings up to 85k per person per institution if.

. Here individuals who have extra money can lend it to others. Earn across multiple markets spreading risk and maximizing reward. Customers can apply to borrow 100 to repaid over 4 to 6 months in equal repayments.

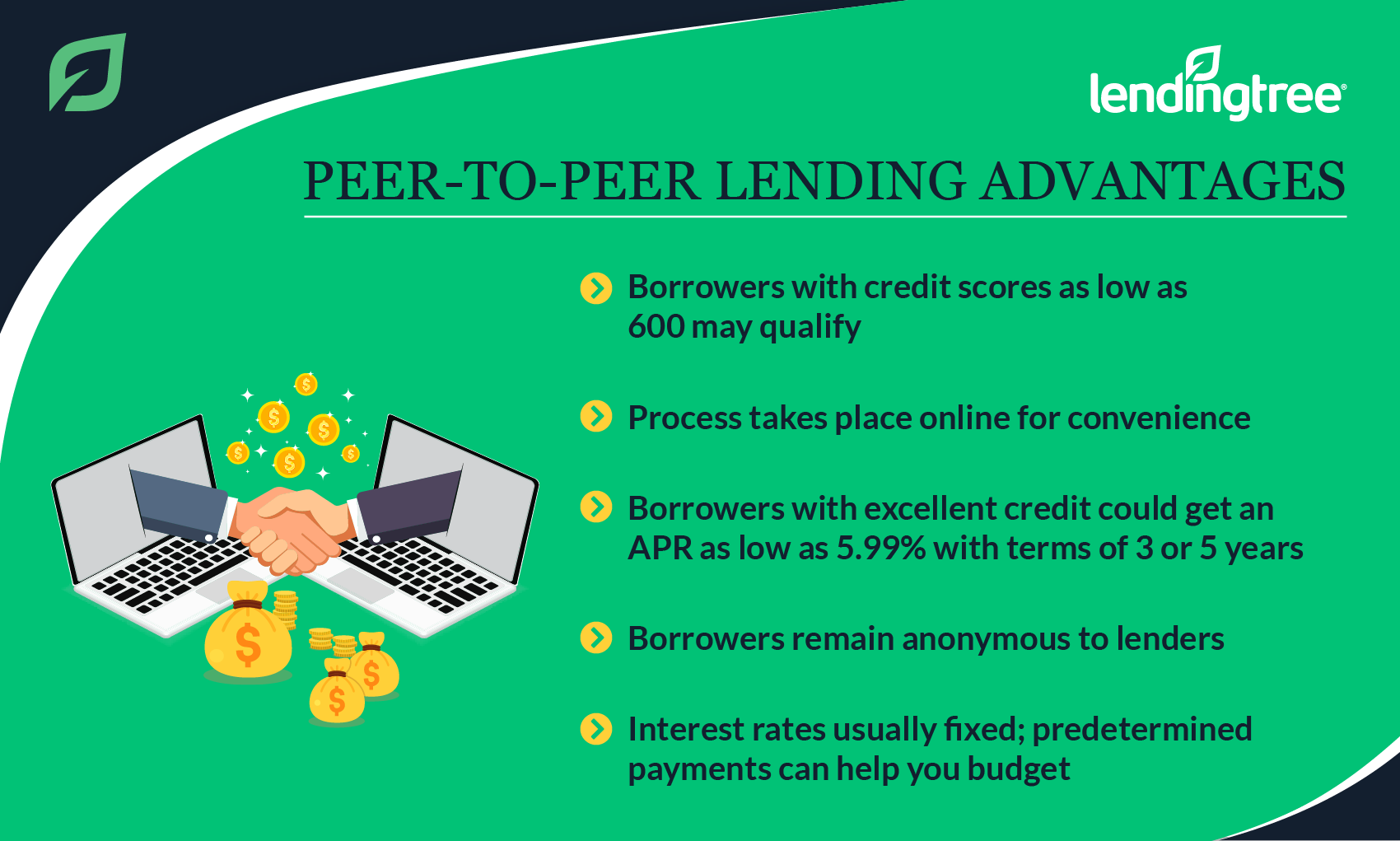

We compared and reviewed the best peer-to-peer lenders based on loan rates fees required credit score and more. Our flexible terms mean that there are no late fees and we will always work with our customers to minimise default or bad debts. In a market where lending approval can take days thats an important advantage.

Peer-to-peer loans are funded by individual and institutional investors. When you lend money to individuals you risk them defaulting. P2P Credit offers personal loan access up to 40000.

Before you use your cards check your available line of credit and your monthly interest rate. Now avail personal loans even with bad credit scores Indian Individuals and corporate lenders can lend money online to eligible borrowers and earn high returns on Investments on this lending platform. P2P lending is generally done through online platforms that match lenders with the potential borrowers.

Some students with no other alternatives use peer-to-peer lending sites. This offer cannot be combined with the SoFi Checking and Savings direct deposit rate discount on a SoFi personal loan. Peer to peer lenders who suffer bad debts on peer to peer loans from 6 April 2016 and relief conditions are met may also set these bad debts against interest received on other peer to peer loans.

Check my eligibility As a. SoFi will credit members who meet qualification criteria within 14 days of the end of the Evaluation Period. Every investment comes with some amount of risk and peer-to-peer lending is no exception.

Our peer-to-peer loans allow people of all credit histories to get access to the funds they need. And because we dont have any brick-and-mortar locations were able to keep. Peer-to-peer lending is a special option that comes with its own requirements terms and conditions.

Loans to homeowners credit assessed and managed by Squirrel. Peer-to-peer lending is a form of direct lending of money to individuals or businesses without an official financial institution participating as an intermediary in the deal. Earn up to 18 pa.

Bonuses are considered miscellaneous income and may be reportable to the IRS on Form 1099-MISC or Form 1042-S if applicable. All P2P NBFC loan projects at RupeeCircle undergo stringent credit analysis including CIBIL- check as well as physical verifications so that a diverse range of robust loan. PIE Tax Portfolio Investment Entity Withdrawals.

With all the financing options out there trying to compare business loans can feel overwhelming. Invest via Select-Invest Auto-Invest IFISA But to lets and SIPP. You can choose from term loans lines of credit invoice financing microloans and more.

Constantly blown away by the impact from the same 25 being lent over. Because of these restrictions many potential boat owners are left without a financing option. Most peer-to-peer transactions are instantaneous and irreversible a fact scammers are known to exploit.

Once you send funds there is no recourse to get the funds back. Thanks to its clever use of technology including an initial soft credit check that does not impact on someones credit rating Zopa is able to offer pre-approval for up to 65 per cent of applicants in as little as 12 seconds. Peer To Peer Lending connects Lenders to Earn Interest by investing in diverse UK Property with Kuflink.

P2P lending allows you to invest in people and businesses around the world for up to 8 APR. We bring you the investment products with risk management strategies previously available only to institutional investors. Lenders on the network can choose to lend to individual borrowers.

By investing in retail loans curated by IndiaP2P. Ive been lending on Kiva since 2009 and Im excited every time I get an email that Ive received repayments and can make another loan. Loans to homeowners credit assessed and.

All lending is backed by cryptocurrency collateral. Prosper was founded in 2005 and was the first peer-to-peer lending marketplace in the United States. The peer-to-peer site gauges the credit profile of the borrower and then provides general information to the lenders.

Online P2P Personal Lending and P2P Personal Loan sites are currently allowing people to connect with one another to get loans online - with real money and in real time. The money goes straight to your bank account through direct peer to peer credit. Get the cash.

30 days notice no charge to withdraw. Our LC TM Marketplace Platform has helped more than 4 million members get over 70 billion in personal loans so they can save money pay down debt and take control of their financial future. Today however peer to peer lending sites offer borrowers boat financing terms without limits on use.

Boaters can receive a 50000 personal loan from a social lending platform which will help them buy the boat theyve only dreamt of before. Finally get the funds in no time with peer to peer business lending at RupeeCircle. There are no updates at the moment.

Lending Loops credit team evaluates your loan request to determine which product is the best fit for your business. Apply Peer-to-peer P2P loan or Lend your money online on Indias best P2P lending marketplace IndiaMoneyMart. You can borrow from traditional lenders banks or credit unions to get the best deals or you can borrow from online lenders for lower loan qualifications.

Just made my 11th loan to a single mother in Nicaragua. Its easy to make a difference in someones life through Kiva. LendingClub is Americas largest lending marketplace connecting borrowers with investors since 2007.

On maturity or use our active secondary market to sell your investment at no cost. Peer-to-peer P2P lending looks like savings but with higher interest eg 5 acts like savings but smells like investing. Please check again soon for more information.

Or borrow against 0 cryptocurrencies from just 6 APR. Lending Loop is Canadas first regulated Peer-to-Peer Lending Platform focused on small businesses. Featuring fixed interest online loans and credit cards with next-day approval and flexible terms.

No matter what type of loan you choose always make sure that you understand all of your financial responsibilities before you sign on the dotted line. Dont use P2P payments to pay for items you purchase from unknown sellers on the Internet. Peer-to-peer lending sites dont come with FDIC insurance like a CD or saving account.

Indias Most Exciting Investment Product for P2P Lending. Peer-to-peer loans lack the same liquidity that youd find in stocks or bonds. The borrowers credit score the.

Peer-to-peer loans are exposed to high credit. Prosper is quick easy and trusted.

Peer To Peer Lending Has Emerged As A Profitable Investment Opportunity For Investors Looking For Better P2p Lending Peer To Peer Lending Personal Loans Online

Peer To Peer Lending Types Advantages

Pin On P2p

This Board Talks About A New And Radical Investment Option Peer To Peer Lending In Order To Encourage The Inve Peer To Peer Lending Peer Investment Portfolio

A Review Of The Best Peer Lending Websites For Bad Credit Don T Think That All Peer To Peer Lending Is The Same Some Sites Credit Repair Loan Improve Credit

What You Need To Know When Applying For A Personal Loan Infographic Peerform Peer To Peer Lending Blog Personal Loans How To Apply Peer To Peer Lending

Pin On Commercial Real Estate

Pin On Rock Your Credit Score

Pin On P2p Lending India Infographics

Funny Quote Maybe P2p Lending Will Change This Peer To Peer Lending Business Loans P2p Lending

Top Options For Peer To Peer Business Lending Lantern By Sofi

9 Things Borrowers Should Watch Out For Lendingtree

Prosper Is America S First Peer To Peer Lending Marketplace Connecting People Looking To Borrow Money With Peop Personal Loans Peer To Peer Lending Need Money

Personal Loan Apply Online Peer To Peer Lending Personal Loans Best Payday Loans

6 Best Online Peer To Peer Loans For Bad Credit 2022 Badcredit Org

How To Get A Personal Loan Personal Loans Loan Loan Lenders

The Ultimate List Of Peer To Peer Lending Sites For 2020 Peer To Peer Lending Lending Site Peer